Staying informed about the latest philanthropic trends is crucial for nonprofit fundraisers. One of the fastest-growing methods in charitable giving is the donor-advised fund (DAF). Nonprofits rely heavily on this type of funding for a variety of purposes. For instance, nearly 60% of DAF grants were allocated for general nonprofit operating support, often a high-priority funding category.

Let’s take a look at how DAFs work, their advantages, and strategies to integrate them into your fundraising efforts.

The Essentials of Donor-Advised Funds: What You Need to Know

A donor-advised fund (DAF) is a giving account managed by a third-party sponsor, like a community foundation or public charity. Donors establish DAFs with assistance from financial advisors or estate attorneys.

After setting up a DAF, donors can contribute various assets—such as cash, stocks, or cryptocurrency—and receive an immediate tax benefit. The funds are then invested to grow tax-free, allowing donors to recommend grants to their preferred charities over time. Another benefit for donors is that DAFs are simple to set up with limited paperwork required.

To stay up-to-date on data related to DAFs in the nonprofit sector, check out reports published by The National Study on Donor Advised Funds.

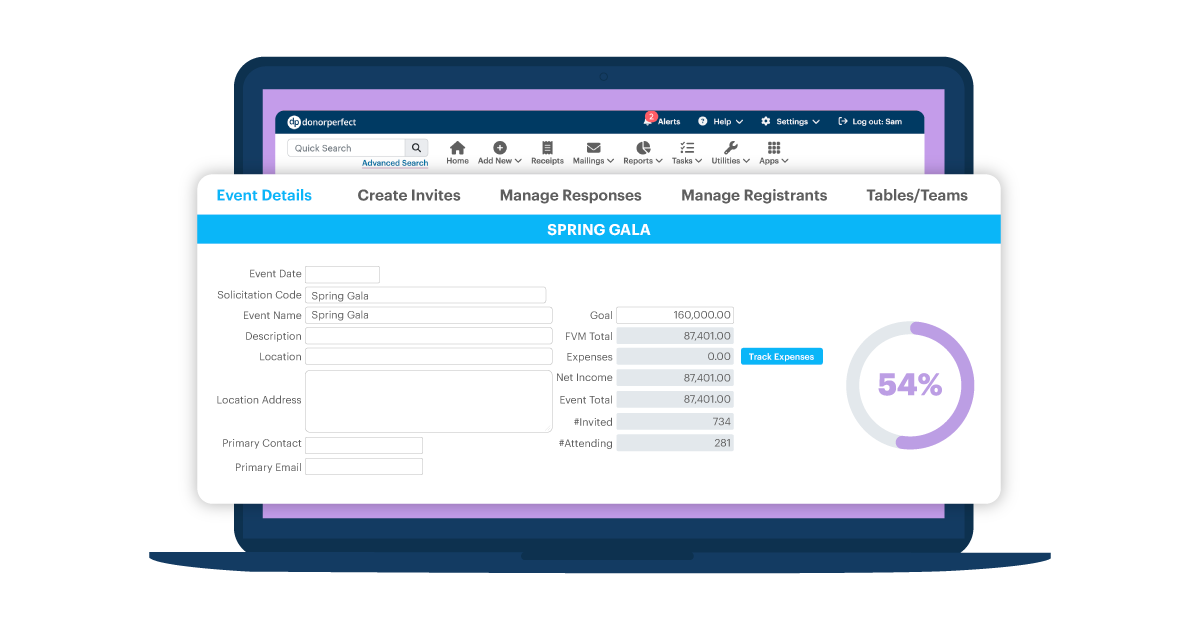

A nonprofit CRM can help you move from transactional relationships to transformational impact. For example, DonorPerfect includes robust relationship management tools to help you build the kind of connections that result in DAFs, pledges, and monthly donations.

4 Key Ways Donors Leverage DAFs

Understanding why donors choose DAFs can help position your organization to receive these gifts. Here are four common ways donors utilize DAFs:

- Maximize impact: Donors can grow their philanthropic funds through investments, resulting in increased giving.

- Streamline giving: DAFs offer a one-stop solution for managing multiple charitable contributions.

- Donate complex assets: DAFs simplify the process of contributing non-cash assets like stocks, real estate, or cryptocurrency.

- Leave a legacy: DAFs offer a structured way for families to engage in multi-generational philanthropy.

Pro tip: Engage the children of DAF donors to build connections with the next generation, who may become future advisors of the fund.

Winning DAF Strategies: How to Secure Gifts for Your Nonprofit

1. Highlight DAFs as a valuable giving option

Make it clear on your website, newsletters, and fundraising materials that your organization accepts DAFs. Include phrases like “recommend a grant from your donor-advised fund” in your appeals and highlight the benefits of DAF gifts.

2. Engage families

Most (97%) of DAFs are advised by both individuals and families. Since families are heavily involved in DAF decisions, it’s important to engage them regularly. Host family-friendly stewardship events or create a Junior Board to connect with younger generations. This can help sustain long-term support.

3. Cultivate major gifts

Donors who give through DAFs are often strong candidates for major gifts. Treat these donors with the same care as other major gift prospects while recognizing the unique aspects of their giving.

4. Encourage recurring and planned gifts

Many DAF sponsors allow for recurring grants. Promote recurring gifts to provide a stable funding source. Bequests account for about 10% of philanthropic giving, so be sure to educate donors on including your nonprofit in their planned giving strategy by naming your organization as a DAF beneficiary.

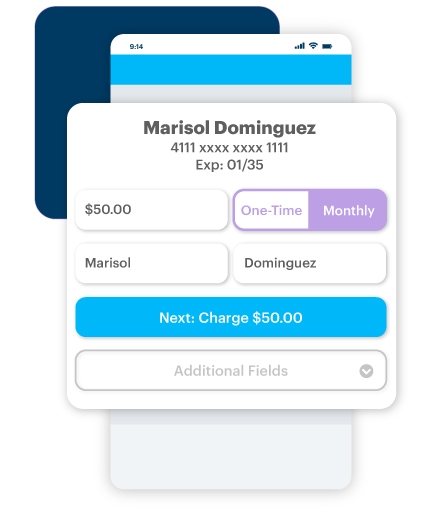

With DonorPerfect, you can streamline your donation collection with an integrated payment processing tool. This tool collects various gift types, including online, recurring, and mobile.

DAF Acceptance Protocols: Nonprofit Best Practices

To effectively integrate DAFs into your fundraising strategy, consider these best practices:

- Understand the roles of the charitable sponsor, donor, and your organization.

- Learn DAF rules, including restrictions on using funds for pledges.

- Properly credit both the sponsor and donor when recording gifts.

- Follow sponsor instructions for personalized thank-you notes.

- Promote DAFs for recurring, major, and planned gifts to boost revenue.

- Include DAF options in all fundraising appeals and materials.

- Assess your nonprofit’s gift acceptance policies and ability to accept DAFs.

- Know how to acknowledge DAF gifts appropriately.

Did you know? An average of 87% of charities that ask for a donor-advised fund gift receive a contribution within three years, compared with 42% of nonprofits that do not ask. Simply asking for a DAF gift more than doubles your likelihood of receiving one!

During your nonprofit’s next development planning cycle, be sure to incorporate DAFs into your overall fundraising strategy.

Donor-advised funds are an increasingly important source of charitable giving. By understanding DAFs, the motivations behind their use, and best practices for accepting these gifts, you can position your nonprofit to tap into this growing revenue stream.

By integrating DAFs into your development plan, you can cultivate donations that benefit your organization now and in the future. Consider DAFs as an essential tool for sustainable fundraising growth. Download DonorPerfect’s e-book: A Fundraiser’s Guide to Donor-Advised Funds.

Frequently Asked Questions

1. Can DAFs be used to fulfill a donor’s pledge?

2. How do we recognize a DAF gift?

3. Are there any costs associated with accepting a DAF gift?