Acknowledging supporters is fundamental to successful fundraising. Expressing gratitude not only strengthens donor relationships, but it also increases the likelihood of continued support and engagement with an organization’s mission. However, when it comes to thanking donors, nonprofits often encounter numerous challenges.

Let’s take a look at some of these problems and ways you can address them.

7 Nonprofit Thank-You Problems and How to Avoid Them

Problem #1: Forgotten thank yous

Ever been in a situation where someone doesn’t say “thank you” when you hold the door open for them? It’s annoying, right? The same goes for donors. When nonprofits fail to send thank-you messages, it can leave donors feeling unappreciated and less likely to give again.

Solution: Make thanking donors a top priority.

Thanking donors should be at the top of your team’s to-do list. Get everyone in your organization on board with the importance of expressing gratitude and the positive impact it has on donor retention. Explore donor management software or website integrations that can automatically send thank-you emails right after a donation is made.

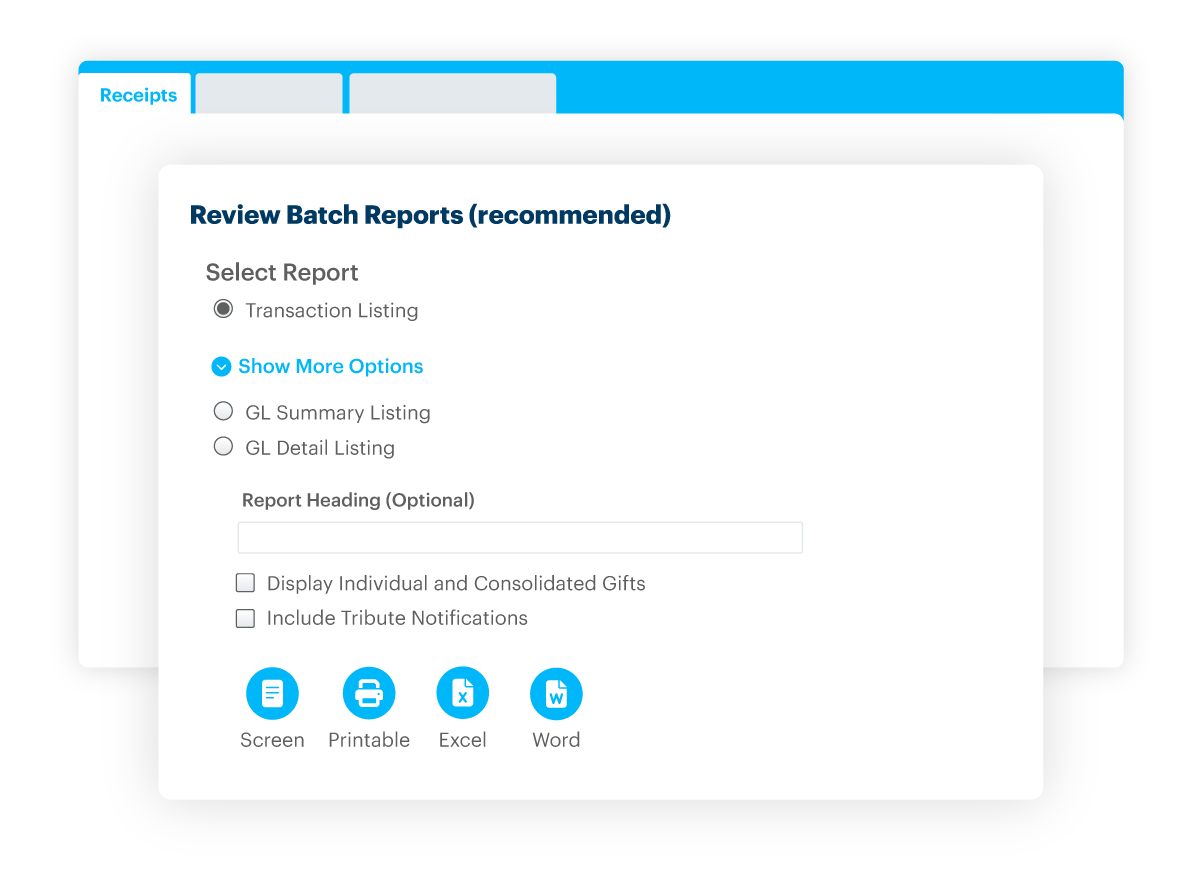

Quickly enter gifts and thank donors by using tools like batch gift entry and customized receipting in DonorPerfect to send emails and letters. Use a different donor management system? Check your tool and integration options.

Problem #2: Delayed thank yous

Nonprofits tend to suffer from high turnover and insufficient staffing. With limited resources and competing priorities, the process of generating and sending thank-you letters may get deprioritized or fall behind other tasks. But timing is everything.

Solution: Formalize a thank-you letter process.

Create a policy or procedure that outlines the steps to be followed immediately after receiving a donation. Designate a specific staff member or team responsible for processing donations and ensuring timely thank-you messages are sent. Clearly define the timeline for acknowledgment, aiming to respond within 48 hours of receiving the donation.

Problem #3: Errors in thank-you letters

Nonprofits that lack appropriate technology tools may struggle to properly thank donors. Without automated processes in place, staff members must handle each step manually, leading to potential errors like sending a letter addressed to the wrong donor.

Solution: Leverage automation.

Implement donor management software or a constituent relationship management (CRM) system that offers automated features for sending thank-you messages to ensure they’re sent consistently and on time. Set up templates that can be personalized with donor-specific details, like name and donation amount.

With DonorPerfect, all gifts are automatically sorted into your donor records and acknowledged, reducing errors and saving you time.

Problem #4: Check donations

Typically, sending a thank you is the last step in entering the gift into fundraising software.

By the time this occurs, several days have passed. The check had to make its way through the mail to your nonprofit, then sorted and delivered, then to finance to verify and deposit, and finally the details manually entered into your fundraising CRM.

Solution: Encourage online donations.

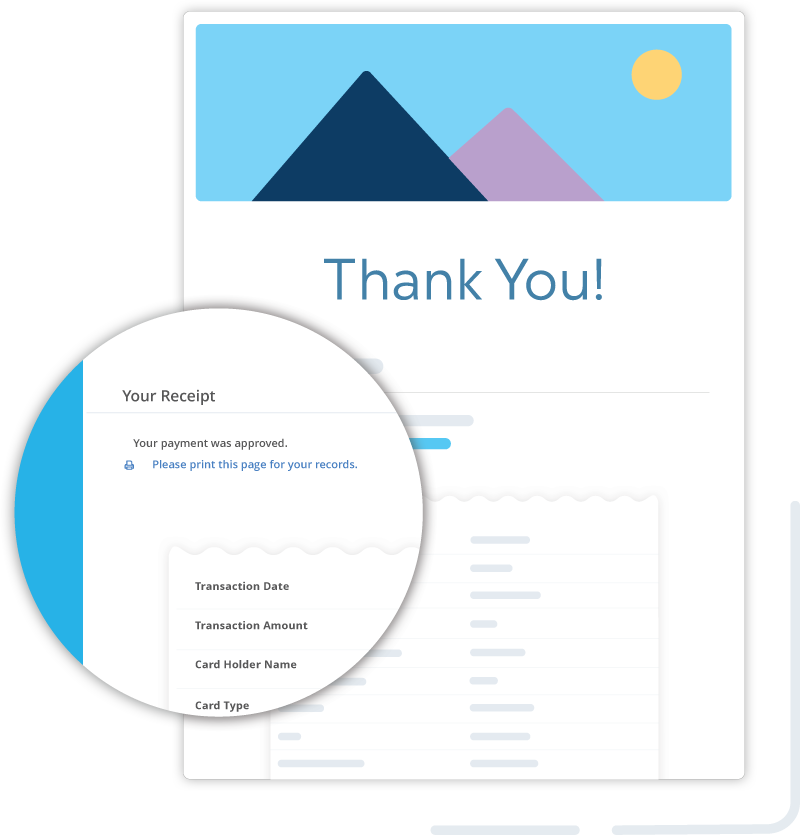

Online giving provides a hassle-free experience, allowing donors to make contributions quickly from anywhere, eliminating delays associated with checks. By setting up your fundraising system to accept online donations and automate gift receipts and thank-you emails, you’ll ensure timely acknowledgments while reducing data entry efforts.

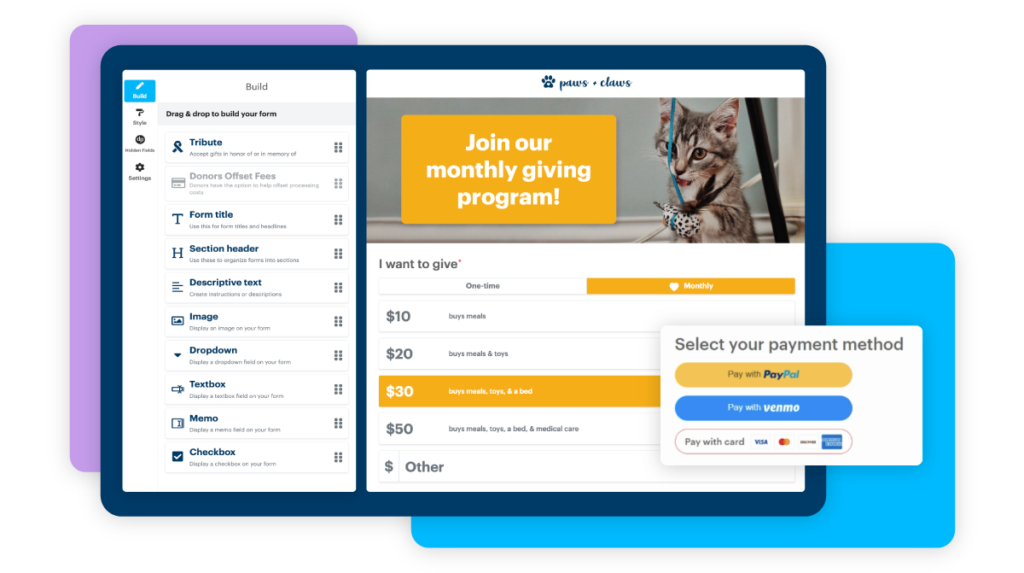

DonorPerfect clients: Give your supporters a fast, streamlined donation experience with DonorPerfect Online Forms.

Don’t have DonorPerfect? Request a demo to get started.

Problem #5: High donation volume

During peak periods or fundraising campaigns, nonprofits may experience a high volume of donations. Handling a large influx of contributions can overwhelm an organization’s capacity to promptly acknowledge each donor.

Solution: Rely on volunteers.

Reach out to your volunteer network to recruit individuals who are willing to help with thank-you letters. Be sure to provide comprehensive training and a copy of the policy you developed. And don’t forget to thank them for their efforts!

Problem #6: Lack of personalization

Nobody likes receiving a generic, cookie-cutter thank-you note. Donors want to feel special and appreciated for their unique contributions.

Solution: Customize your thank-yous

Put a personal touch on your thank-you messages. Create templates for different types of gifts like new donors, repeat donors, or those who gave more generously. You can even add a handwritten note to show extra sincerity. The more personalized, the better.

Problem #7: Non-standard donations

Sometimes donors get creative with their contributions. They might donate appreciated stocks, give through donor-advised funds, or participate in matching gift programs. But nonprofits often struggle with appropriately acknowledging these non-standard donations.

Solution: Streamline and automate your processes.

Set up clear guidelines and template letters for appreciated assets, donor-advised fund grants, matching gifts, and anything out of the ordinary. This way, you can ensure that donors receive the recognition they deserve, regardless of the type of gift they’ve made.

Get support for giving thanks

Are you facing any of these problems? Address them head-on. Thanking donors isn’t just good manners, it’s the key to nurturing long-term support and building a thriving nonprofit community. DonorPerfect offers a complimentary digital thank-you kit – unlock the potential of gratitude by downloading your free copy below.