Online giving is a core part of nonprofit fundraising. When a donor clicks “submit” on a donation form, they expect the experience to be quick, secure, and seamless—often from a phone, and often in the moment.

If your organization wants to grow online fundraising, donation processing must work smoothly at the exact point of decision. Transparency also plays a critical role in sustaining long-term relationships with supporters.

While donation forms look simple to donors, the donation and credit card processing behind that experience are far more complex, and those details directly affect how much revenue your nonprofit retains.

For nonprofit fundraisers and leaders, understanding payment processing and associated fees helps build donor trust while making informed decisions that keep more resources focused on your mission.

This guide breaks down how donation processing works, why credit card processing costs vary, and how nonprofits can manage—or recover—those costs thoughtfully as part of a smart online fundraising strategy.

What is online donation processing?

Every online gift passes through multiple systems, each with its own fees and rules. Understanding how nonprofit credit card processing fits within your online fundraising system helps organizations manage costs more intentionally while protecting donor trust.

Online donation processing refers specifically to how philanthropic gifts are securely transferred from a donor’s credit card or bank account—or through a digital wallet such as PayPal, Venmo, or Apple Pay, which are typically connected to a card or bank account—into your nonprofit’s account through your online fundraising tools and donation forms.

While payment processing can include many types of transactions—such as event tickets, program fees, or merchandise—donation processing is designed to support charitable giving and donor relationships.

Behind the scenes, each online donation relies on several systems working together:

- The donor’s card network (Visa, Mastercard, American Express, etc.)

- The issuing bank

- The payment processor

- Your nonprofit’s online fundraising or donation platform

- In some cases, a digital wallet provider that securely routes payment details between the donor and the processor

Each of these parties takes a small fee. When you’re processing hundreds or thousands of online donations—especially smaller gifts—those fees add up quickly and directly affect net revenue. Understanding how transactions are reconciled at the system level helps ensure donation data is accurate, complete, and ready for reporting.

Pro tip: Streamline donation processing using your nonprofit CRM.Integrated online fundraising tools reduce errors, eliminate duplicate fees, and simplify reconciliation, saving staff time while protecting donor trust. Modern donation forms can also support multiple payment options—including PayPal, Venmo, Apple Pay, and DAFpay—helping donors give through the method they prefer while keeping processing connected within one system

The basic fees behind every online donation

Most nonprofits encounter some combination of the following costs when processing online donations:

- Transaction fees – A percentage of each donation, for example, 2–4% per transaction, depending on card type, processor, and pricing model (this percentage fee is typically charged in addition to any flat per-transaction fee)

- Flat per-transaction fees – A fixed amount added to each gift, such as $0.20–$0.40 per donation, which can have a greater impact on smaller gifts (this flat fee is commonly applied alongside the percentage-based transaction fee)

- Platform or gateway fees – Monthly or per-form charges that may be associated with your nonprofit’s online fundraising or CRM tools, depending on how services are priced

- PCI compliance fees – Costs associated with maintaining secure payment standards for handling cardholder data, which may be charged directly or bundled into processing or platform fees

Individually, these fees may not seem significant. Together, they can add up quickly across high-volume donation forms and online fundraising campaigns. Across high-volume online fundraising efforts, combined processing and platform costs can reasonably total 5–10% or more of online donation revenue, depending on gift size, volume, and payment mix.

The hidden cost of credit card processing

Credit card processing fees can influence how nonprofits plan, grow, and evaluate online fundraising, especially when those costs accumulate across multiple donation forms and smaller online gifts.

Here’s where the impact most commonly shows up:

- Small gifts take the biggest hit – Flat per-transaction fees can represent a much larger share of a $10 donation than a $250 gift

- Budget forecasting becomes harder – Variable fees make it more challenging to predict how much funding will ultimately be available after processing costs

- Campaign ROI can be misleading – Gross revenue may appear strong, while net revenue tells a more complete story once fees are accounted for

Campaign example:

An online campaign that raises $50,000 may be a clear success by most measures. However, once processing fees, platform charges, and per-transaction costs are applied, the net revenue available for programs can be noticeably lower—sometimes by several thousand dollars—depending on gift size and volume. For example, a $50,000 campaign with an effective processing rate of 5–7% could result in approximately $2,500–$3,500 in combined transaction and platform costs before funds reach your programs.

For organizations operating with tight margins and ambitious goals, understanding these dynamics can help leaders make more informed decisions about online fundraising strategy and expectations.

DonorPerfect is our daily driver for all fundraising, donation collecting, receipting, and processing for our large organization.

– Kathleen G

Why donation processing and nonprofit credit card processing vary so widely

If you’ve ever compared processors and felt confused or overwhelmed, you’re not alone. Donation processing and credit card fees for nonprofits can vary significantly based on pricing structure, transaction volume, and payment mix, and the lowest advertised rate isn’t always the most cost-effective option over time.

Common nonprofit credit card processing models

The structure your organization uses can significantly influence both transparency and long-term costs.

Flat-rate pricing

A pricing model where most transactions are charged the same percentage rate, regardless of card type or transaction details.

- Simple and predictable, with consistent fees across transactions

- Easier to budget every month

- Can result in higher overall costs for some organizations, particularly at higher volumes

- Common among all-in-one online fundraising platforms

Did you know? DonorPerfect Payment Services offers transparent flat-rate pricing designed specifically for nonprofits, helping organizations simplify budgeting and reduce surprises.

Interchange-plus pricing

A model that separates the base card network fee (interchange) from the processor’s markup, so nonprofits can see how costs are structured.

- Generally more transparent, with fees tied to actual card network costs

- Rates vary by card type and transaction details

- May result in lower effective costs for nonprofits with higher volume or larger average gifts

- More common with traditional merchant accounts than bundled fundraising platforms

Tiered pricing

A structure that groups transactions into pricing tiers, each with its own rate, based on how the transaction is classified.

- Transactions are categorized into different pricing levels

- Can be less transparent, making it harder to understand how individual fees are calculated

- In some cases, may result in higher effective costs depending on how transactions are categorized

Key takeaway: Pricing complexity can make it difficult for nonprofits to fully understand what they are paying. Greater clarity around pricing models helps organizations compare options more effectively and make informed decisions about donation processing.

Pro tip: Ensure uninterrupted recurring donations with automatic updates for expired cards.

DonorPerfect’s Credit Card Updater automatically refreshes donors’ credit card information nightly, helping nonprofits maintain recurring donations when cards expire or are replaced, without adding barriers for donors.

Should nonprofits ask donors to help cover donation processing fees?

This is a common topic of discussion among nonprofit fundraising teams, especially as online fundraising continues to grow.

Asking donors to help offset donation processing or credit card fees can increase net revenue. It can also erode trust if handled poorly. The approach itself is not the issue. How it is introduced and framed makes the difference.

What nonprofits commonly see in practice

Many organizations that offer donors the option to cover processing fees report:

- Higher net revenue per gift when donors opt in

- Little to no impact on conversion when the option is clearly explained

- Greater acceptance among repeat donors who already feel connected to the mission

The deciding factor usually is not whether the option exists, but how clearly and respectfully the choice is framed.

Pro tip: Offer fee coverage transparently—and always as an option.

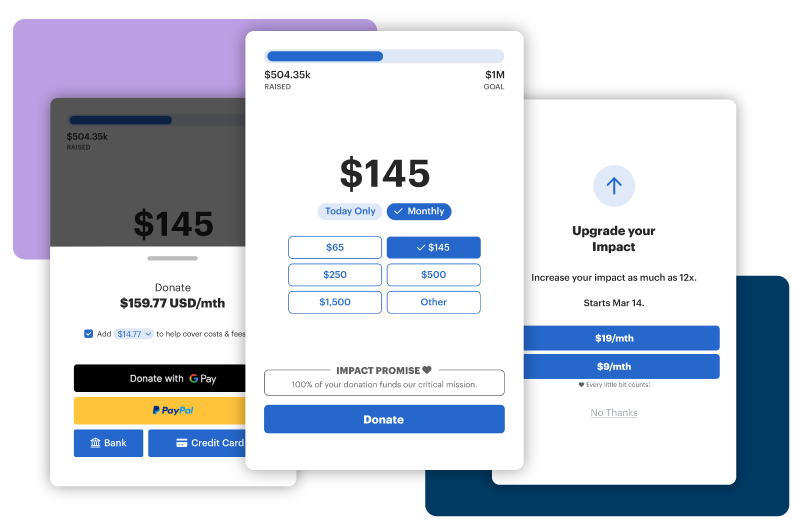

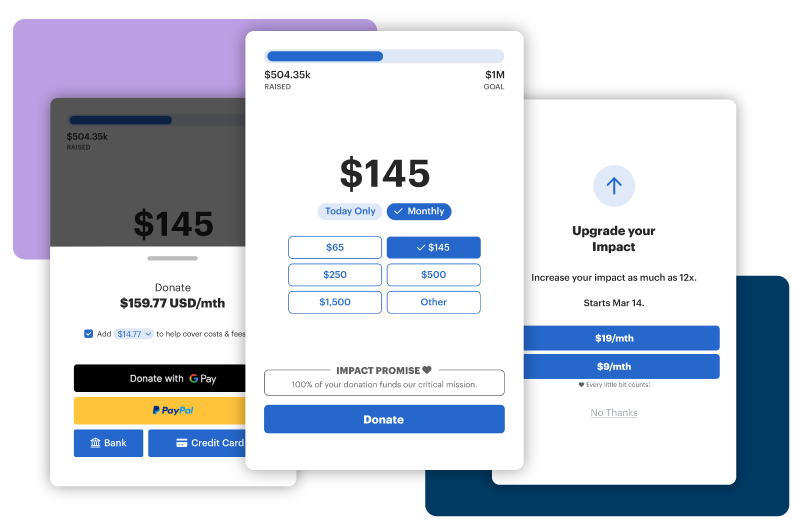

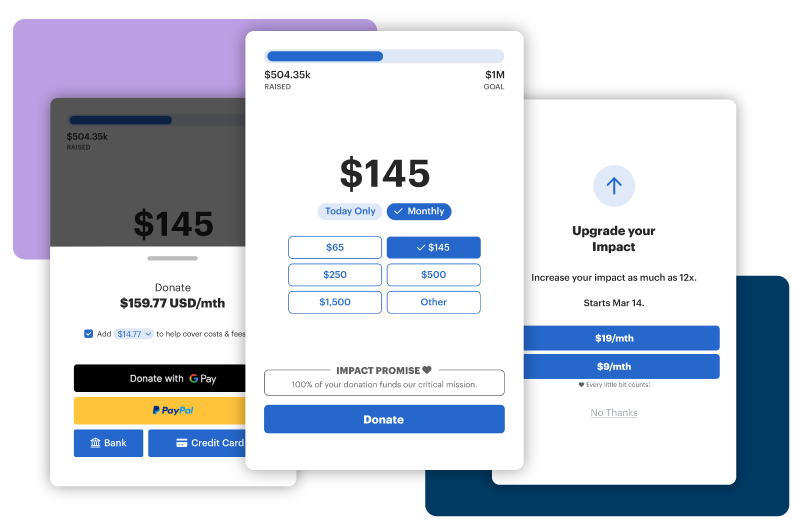

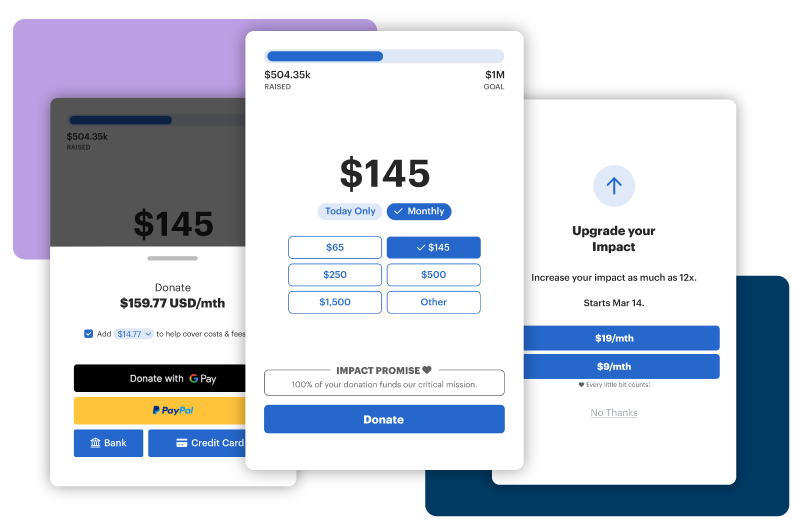

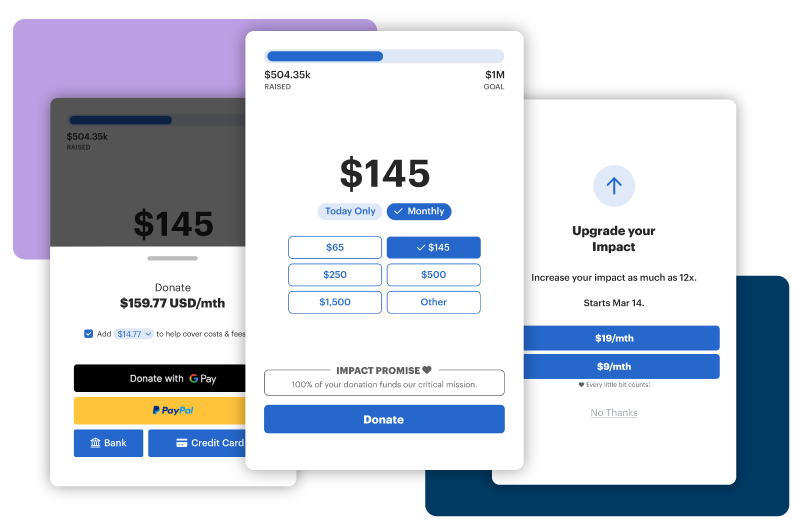

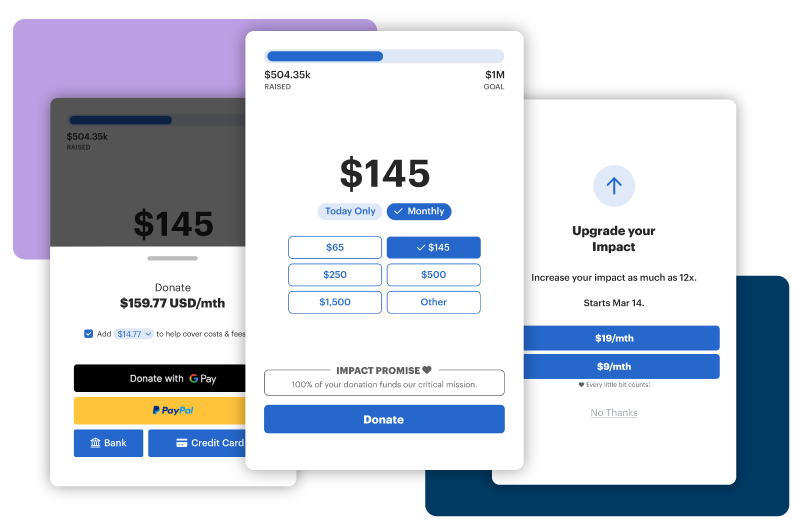

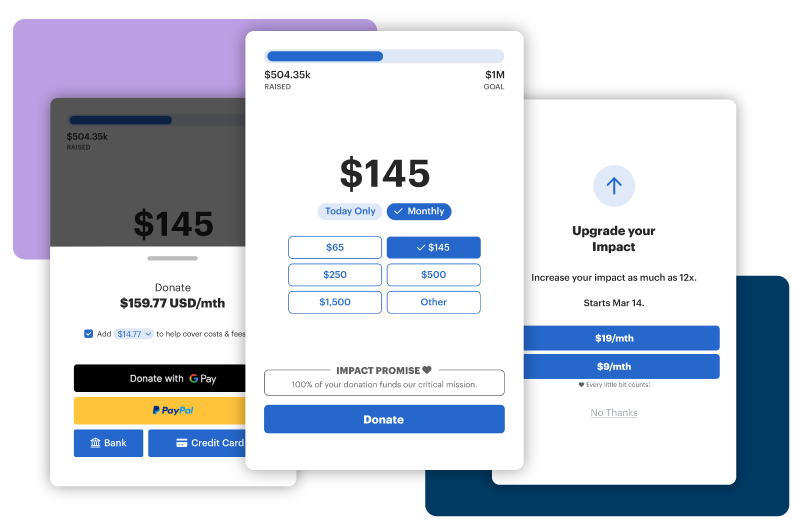

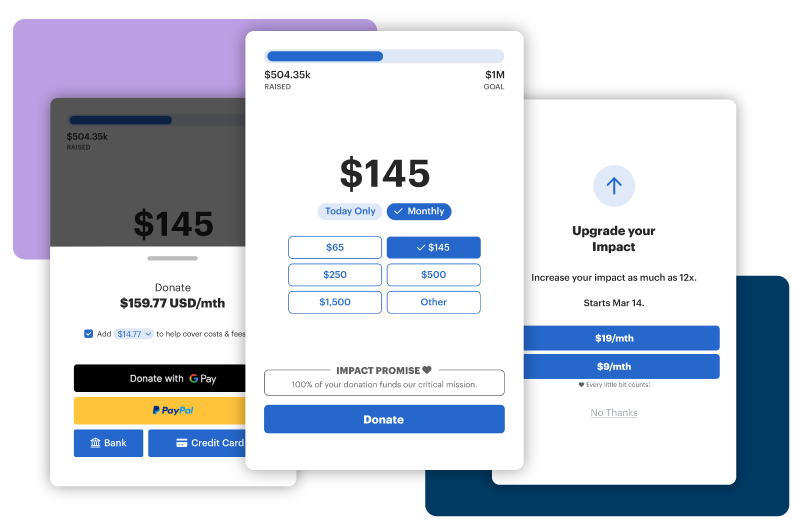

DonorPerfect and Givecloud donation forms include the Donors Cover Costs feature, allowing nonprofits to present optional fee coverage during the giving process, helping increase net revenue while maintaining a positive donor experience.

How to ask donors to cover fees without damaging trust

Surprising donors with unexpected fees on online donation forms is one of the most common ways to create obstacles or frustration in the giving experience. When donors feel caught off guard, even a small request can feel transactional rather than supportive. Thoughtful fee recovery on donation forms depends less on what you ask and more on how you ask.

Best practices include:

- Making the option clearly voluntary – Donors should always feel they have a choice, with no default selection

- Using plain, respectful language – Avoid guilt-based messaging or language that pressures donors

- Explaining the impact, not the mechanics – Focus on how covering fees helps support the mission, rather than how payment systems work

- Framing it as a choice, not an expectation – Position fee coverage as an optional way to increase impact

When donors understand that covering fees helps direct more of their gift to mission delivery, many are comfortable opting in, especially when the request feels transparent and aligned with their intent.

aligned with their intent.

Examples of donor-friendly language include:

- “Direct more of your gift to programs by covering processing costs (optional).”

- “Add an optional amount to offset transaction fees.”

- “Choose whether you’d like to cover processing costs for your donation.”

When these practices are followed, fee coverage feels like an informed choice rather than an extra charge, helping protect both donor trust and long-term relationships.

Effective ways to reduce processing costs without asking donors

Asking donors to help cover fees is only one option. Many nonprofits reduce processing costs through operational choices that shape how donations are accepted and processed. Thoughtful decisions about payment methods, giving options, and systems can have a meaningful impact on net revenue over time.

Strategic cost-control tactics

- Encourage ACH or bank transfers for larger online donations – These methods often carry lower processing costs and are well-suited for higher-dollar gifts

- Promote recurring giving – A recurring giving program sustains revenue while reducing acquisition costs and administrative effort

- Optimize suggested donation amounts – Offering suggested giving amounts offsets flat per-transaction fees, especially on smaller gifts

Consolidate platforms – Consolidating tools reduces duplicate charges, manual work, and fragmented reporting

Even small adjustments to your online fundraising setup can add up to meaningful savings without changing the donor experience.

Pro tip: Take a system-wide view of processing costs, not just transaction rates.DonorPerfect’s unified fundraising platform helps nonprofits evaluate net revenue more accurately by reducing duplicate fees, minimizing manual work, and bringing donation and payment data into a single, connected system.

Transparency is the real trust builder

Donors don’t expect nonprofits to operate without costs. They do expect those costs to be handled openly and explained clearly.

Transparency around donation processing and credit card fees helps set the tone for the entire donor relationship. When nonprofits are upfront about how online donations are processed—and where fees come into play—it reinforces trust and reduces friction at critical moments in the giving experience.

Clear, consistent communication around processing costs:

- Signals responsible financial management – Donors and nonprofit leaders alike can see that funds are being handled thoughtfully

- Builds confidence among donors and internal stakeholders – Transparency reduces uncertainty and strengthens credibility

- Supports long-term donor relationships – Donors who feel informed are more likely to continue giving over time

The goal is to avoid vague explanations or surprises that leave donors guessing. When nonprofits treat donors as informed partners—rather than just transactions—trust grows naturally.

Pro tip: Use transparency to strengthen retention, not just compliance.Donation processing tools within DonorPerfect help nonprofits clearly communicate payment options, manage recurring gifts, and reduce barriers in the giving experience, supporting donor trust and long-term retention.

Choosing when fee recovery supports your fundraising strategy

Fee recovery works best when it’s applied intentionally, not universally. Different fundraising channels come with different donor expectations, gift sizes, and cost structures. Those differences should guide when and how you offer donors the option to cover processing fees.

In some contexts, fee recovery can help protect net revenue without disrupting the donor experience. In others, it can create unnecessary friction or distract from relationship-building.

Contexts where fee recovery often makes sense include:

- Online campaigns with smaller average gifts – Helps protect net revenue when flat processing fees have a larger impact on each donation

- Peer-to-peer fundraising – Allows supporters to maximize the value of the gifts they inspire, especially across many small transactions

- Giving days and digital appeals – Supports momentum during high-volume, time-bound campaigns where processing costs add up quickly

Pro tip: Use fee recovery selectively in high-volume peer-to-peer campaigns.

Peer-to-peer fundraising often generates many smaller gifts, where flat processing fees can significantly affect net revenue. Offering optional fee recovery in these campaigns helps protect overall results without increasing internal fundraising costs.

Knowing when not to introduce fee recovery is just as important. In certain situations, the potential downside outweighs the financial benefit.

Situations where fee recovery is typically best avoided include:

- Major gifts – Fee conversations can distract from relationship-centered, personalized giving

- Grant-related donations – Grant funds are typically paid by check, ACH, or wire transfer, meaning standard online processing fees may not apply

- Donor-advised fund contributions – These funds are typically issued by the sponsoring organization via check or ACH, so standard online credit card processing fees do not apply

Thoughtful fee recovery decisions balance financial realities with the type of donor experience your organization wants to preserve.

Pro tip: Align fee recovery decisions with how revenue is reported.

DonorPerfect’s reporting tools and dashboard analytics help nonprofit leaders track gross donations, processing costs, and net revenue in one place, making it easier to evaluate how fee recovery strategies affect overall fundraising performance across channels.

Online fundraising will always involve costs. What matters most is how intentionally those costs are managed, with donor trust at the center.

When organizations understand donation processing, communicate transparently, and give donors clear choices, they are better positioned to protect relationships while keeping more funding focused on mission delivery. That balance reflects responsible stewardship in action.

Ready for online fundraising that works better for donors and staff alike? Get started with online fundraising using DonorPerfect’s tools to simplify donation processing, strengthen transparency, and support long-term growth.

Frequently Asked Questions

1. Is it legal to ask donors to cover credit card processing for nonprofits?

2. Do donors receive a tax deduction for the portion covering fees?

3. Will asking donors to cover donation processing fees hurt retention?

4. Are ACH donations always cheaper than credit cards?

5. How often should nonprofits review credit card processing costs?

6. Should nonprofits use the same fee strategy across all fundraising channels and donation forms?

Follow us on social!