With Aaron Harris, Chief Technology Officer of Sage Intacct

Financial clarity does more than keep nonprofits compliant—it builds donor trust and enables better decisions across the organization. As nonprofit operations grow more complex, nonprofit accounting software has moved from a back-office utility to a mission-critical system that connects finance, fundraising, and leadership.

In a recent episode of Nonprofit Expert, DonorPerfect Product Manager Darryl Moser spoke with Sage Intacct Chief Technology Officer Aaron Harris about where nonprofit financial technology is headed. In this post, we recap their conversation about the future of nonprofit accounting software: real-time visibility, smarter automation with strong governance, and tighter alignment between fundraising and accounting teams.

Why nonprofit accounting software directly impacts fundraising success

Fundraisers may not live in the accounting system, but they feel its impact every day. Nonprofit accounting teams track restricted funds, ensure compliance with donor intent, support audits, and produce reports that leadership and boards rely on.

When accounting systems are slow or disconnected, fundraisers experience delays, unclear fund balances, and extra follow-up. Effective nonprofit accounting software brings these responsibilities into a single, reliable system that supports both finance and development teams.

Cloud-based nonprofit accounting platforms have become standard because they reduce IT overhead and scale as organizations grow. For nonprofits, this means less time spent managing systems and more time focused on donors, programs, and impact.

At the center of it all is fund accounting. Nonprofits must clearly track how donations are designated, spent, and reported across programs and time periods. Software that treats fund accounting as a foundational capability—not an add-on—helps ensure donor intent is honored and communicated accurately.

Why fundraising and accounting integration reduces friction for everyone

Fundraising and accounting work best when they’re connected. Yet for many nonprofits, reconciling fundraising activity during the close is one of the most time-consuming steps.

When gift data lacks context—such as fund designations or donor intent—finance teams are left to interpret and correct entries manually.

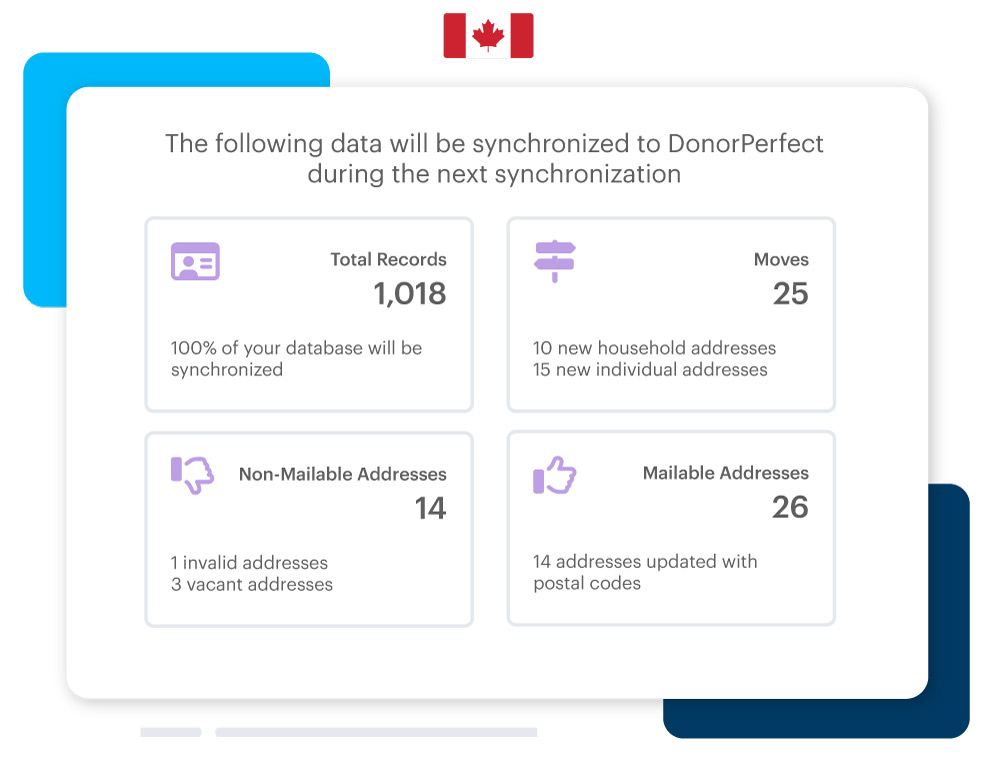

Integrated systems reduce this friction. Sage Intacct Fundraising, the integration between DonorPerfect Fundraising Software and Sage Intacct, shows how connected platforms can streamline workflows. When fundraising and accounting systems share structured data, reporting becomes clearer and more reliable.

For fundraisers, strong integration:

- Reduces follow-up questions from finance

- Improves confidence in reports shared with donors

- Saves time across teams

This level of connection is a defining feature of effective nonprofit accounting software.

Automate data entry, send personalized communications, and keep your staff informed with Sage Intacct Fundraising, the solution that brings fundraising and finance together:

- Streamline in-house donation processing with customizable online forms.

- Automate assignments and alerts for your staff based on donor activities.

- Customize donor communication and updates at the intervals you choose.

- Modernize online fundraising to expand your network and grow your funds.

- Integrate fundraising and financial data to understand your bottom line.

Faster closes mean better decisions for fundraisers and leaders

The monthly close directly affects how quickly nonprofits can make informed decisions. This process pulls together reconciliations, expense reviews, revenue recognition, and compliance checks into a set of financials that leaders trust.

Boards and executive teams rely on closed financials to guide strategy. As Aaron described it, the close represents financial confidence—knowing where the organization truly stands.

Automation has helped many nonprofits shorten this cycle. Some now operate just days behind real time, with fewer last-minute adjustments.

For fundraisers, faster access to reliable financial data means:

- Clearer visibility into available funds

- Better planning for campaigns and initiatives

- Fewer surprises related to restricted gifts or grant spending

Strong nonprofit accounting software reduces delays while maintaining the accuracy and oversight finance teams require.

How automation in nonprofit accounting software saves time without sacrificing trust

Automation and AI are transforming nonprofit accounting—but not by removing people from the process. The goal is to reduce manual work while increasing clarity and confidence.

Aaron highlighted three automation trends shaping modern nonprofit accounting software.

1. Continuous accounting keeps financial data current

When transactions are captured and coded closer to when they occur, fewer corrections are needed later. Over time, nonprofit accounting software becomes a near-real-time reflection of organizational activity instead of a historical snapshot.

This gives fundraisers and leaders greater confidence in the numbers they’re using throughout the month—not just after it closes.

2. Continuous assurance protects donor trust and compliance

Automation only works if teams can understand and verify it. Accounting teams need visibility into how transactions are processed and the ability to review or intervene when something doesn’t look right.

For nonprofits, this is especially important. Errors can affect restricted funds, grant compliance, and audit outcomes. Effective nonprofit accounting software includes audit trails, controls, and review workflows that support trust in automated processes.

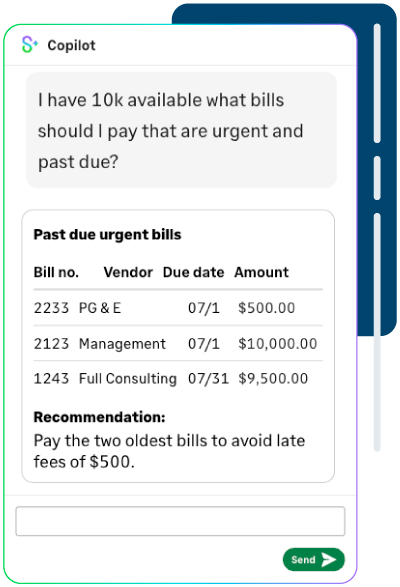

3. Continuous insights support proactive planning

Modern accounting platforms can identify trends, variances, and potential risks—without relying solely on static reports.

For nonprofit leaders, these insights support:

- Smarter staffing decisions

- More confident program investments

- Stronger fundraising and funding strategies

When financial data is timely and reliable, leadership can act proactively instead of reacting after the fact.

Why trust and governance matter in AI-powered nonprofit accounting software

AI adoption in accounting requires care, particularly in the nonprofit sector. Organizations manage sensitive financial and donor data and operate under high expectations for accountability.

That means AI features in nonprofit accounting software must be transparent, well-governed, and easy to understand.

Aaron emphasized several practices that support trust:

- Clear documentation explaining how AI features work

- Transparency around data usage and model development

- Compliance with accounting standards and regulations

- Ongoing monitoring to ensure accuracy and consistency

Purpose-built AI models designed specifically for accounting tasks are especially important. While general-purpose AI tools are powerful, accounting requires precision. Models trained for financial workflows are better suited to nonprofit environments.

Trust in nonprofit accounting software ultimately depends on the ability to understand, review, and govern how automation operates.

What AI agents mean for the future of nonprofit accounting—and your workload

One of the most significant developments in accounting technology is the emergence of AI agents. Unlike task-based automation, AI agents manage ongoing responsibilities.

In nonprofit accounting, that may include:

- Maintaining continuous readiness for financial reporting

- Monitoring allocations across funds and programs

- Processing payables and receivables within defined review rules

- Flagging unusual activity for human review

When implemented thoughtfully, these capabilities can reduce operational strain while maintaining strong controls. As with any automation, success depends on governance and accountability built into the nonprofit accounting software itself.

What fundraisers should look for in nonprofit accounting software

As nonprofits plan for the future, several priorities matter to both finance and fundraising teams:

- Strong support for fund accounting and dimensional reporting

- Timely access to accurate, decision-ready financial data

- Transparent, well-governed use of automation and AI

- Reliable integration with fundraising systems

- A clear roadmap that supports growth and compliance

Nonprofits face increasing expectations for transparency and efficiency. The right nonprofit accounting software helps meet those expectations—while making it easier for fundraisers, finance teams, and leaders to work together in support of the mission.

Schedule your free demo

Explore the capabilities of nonprofit accounting software from DonorPerfect and Sage Intacct