QuickBooks Integration

Manage your fundraising efforts

with a single source of truth for donor & financial data.

Learn More

Why we’re better together

Integrating your accounting software with your fundraising CRM saves staff time by automating processes like reporting, syncing, reconciling gifts, and even thanking donors – during office hours or on the go.

As a proud and trusted QuickBooks Solution Provider, you can now purchase QuickBooks Online directly though DonorPerfect. Achieve peace of mind with a powerful integration that enables your team to manage fundraising initiatives from a single system.

Spend less time on administrative tasks and more time building donor relationships:

- Easily import transactions from DonorPerfect

- Cut time spent categorizing your transactions in half

- Ensure clean, accurate data with audit trails to align your team

- Promote better decision-making for your organization

- Make room in your schedule for more strategic planning

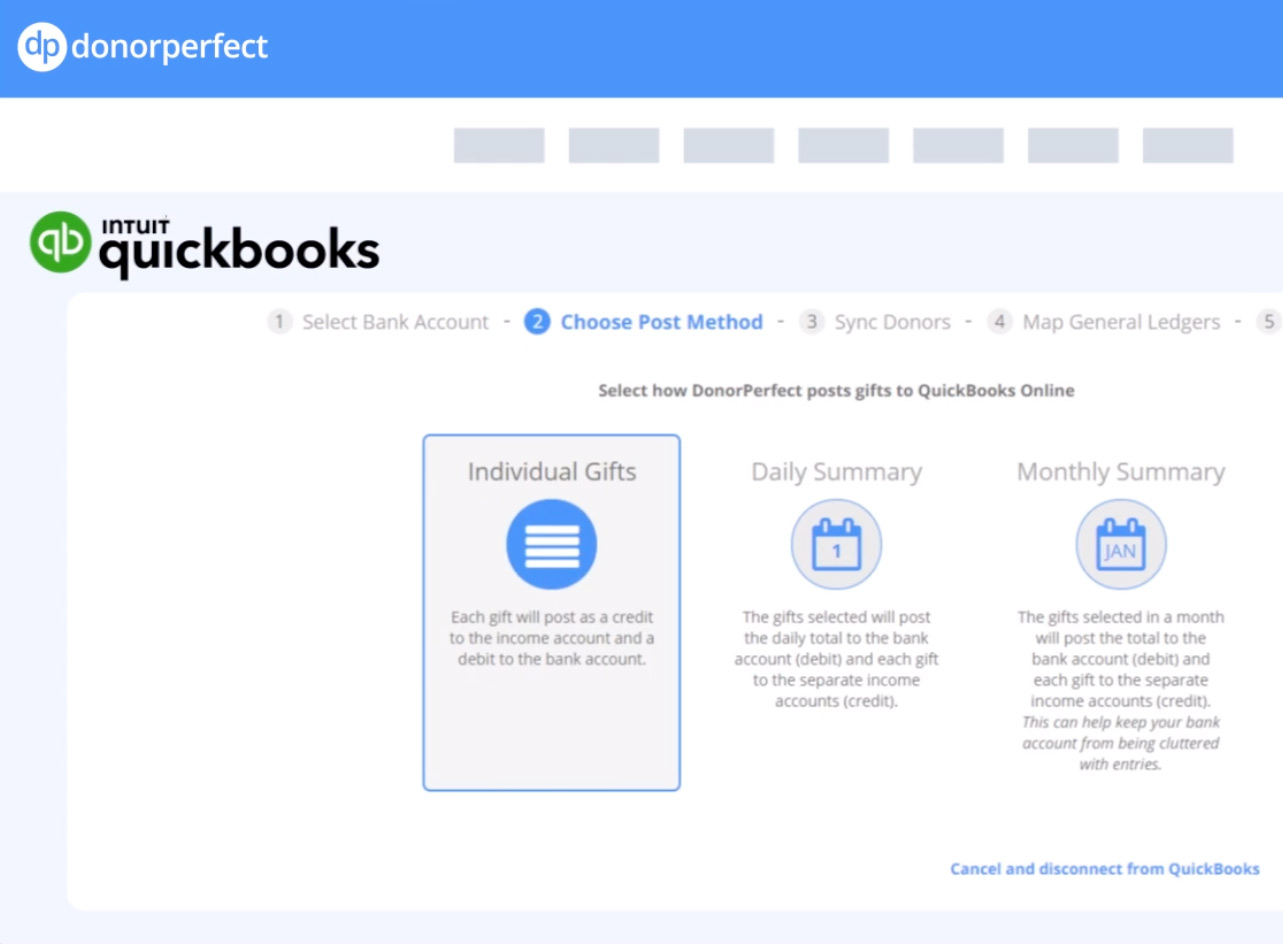

How it works

Start and end your transaction entry with DonorPerfect to avoid manual errors and save countless hours.

Maintain complete details for donors, gifts, pledges, and communication in DonorPerfect, and sync only needed financial data for accounting.

Post

Choose data to send to QuickBooks

Track

Track & reconcile transactions with certainty

Save Time

Avoid double data entry with the click of a button

Follow us on social!