You know those little pieces of paper you send out after someone makes a donation? Yep, we’re talking tax receipts. Well, they are way more exciting than they seem!

For nonprofit organizations, efficient management of tax receipts is crucial for maintaining donor relationships and ensuring financial compliance with tax regulations. As gifts are made, or as year-end approaches, many organizations find themselves overwhelmed with generating and distributing accurate tax receipts to their generous supporters. Fortunately, with the right tools and strategies, this process can be streamlined and automated, saving fundraising teams time while reducing errors.

Ready to turn this tedious paperwork into a powerful fundraising tool? Let’s dive in!

Understanding the importance of tax receipts

Tax receipts serve as official documentation for donors to claim deductions on their tax returns. Providing accurate and timely receipts not only helps your donors but also demonstrates your organization’s ability to be professional and accountable.

Tax receipts boost your transparency, keep you on the right side of the law, and even make your donors appreciate you more! Generating tax receipts for donors – whether in digital or print form – is crucial for nonprofits for several reasons:

- Legal compliance and tax benefits: Registered Nonprofits in Canada can issue tax receipts, which allow donors to claim deductions for gifts with an official document for tax purposes. An official tax receipt is the only way a donor can claim a tax credit.

- Accountability and transparency: Tax receipts demonstrate organizational integrity, helping you build trust with donors and stakeholders while creating a vital audit trail for financial verification.

- Donor stewardship and retention: Receipts serve as formal acknowledgments, providing nonprofits with the opportunity to thank donors and reinforce the impact of their contributions, which is crucial for donor retention.

- Financial recordkeeping: Proper receipts help both nonprofits and donors maintain accurate records of giving history, which are useful for financial planning and future decisions.

- Regulatory compliance: Accurate receipts help nonprofits with their tax reporting and maintaining their registered status, ensuring regulatory compliance.

Establishing an accurate tax receipting system

In today’s digital age, nonprofits can leverage technology like constituent relationship management systems (often called nonprofit CRMs) to automate their gift confirmation and tax receipt management, saving time and reducing errors. We recommend that organizations, small and large, implement a thorough process:

- Utilize CRM functionality: Capture all relevant information at the point of donation with online processing to minimize the risk of errors and omissions in your receipts.

- Automate email receipts with online forms: This integration ensures that donors receive their tax receipts via email quickly and securely, enhancing their experience with your organization.

- Review your processes regularly: On a regular basis, review recommended policies, procedures, and samples for acknowledgment letters and receipts. This is important when changes in staff or fundraising practices occur.

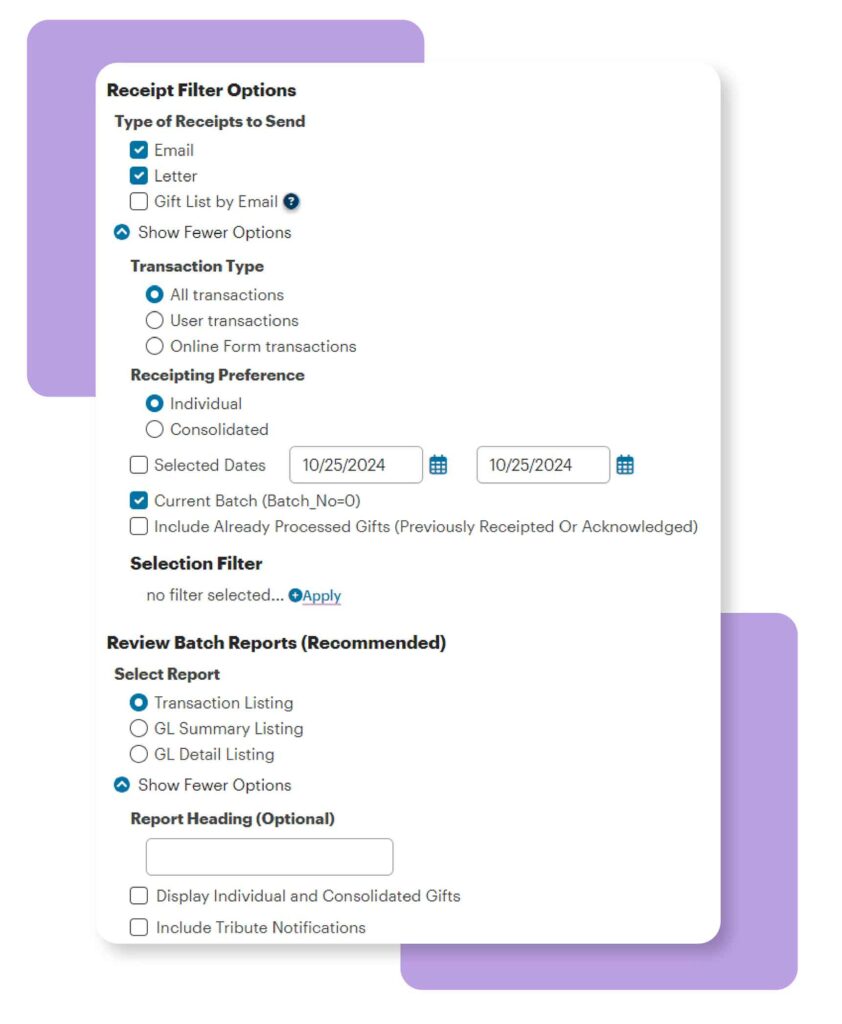

To meet different nonprofit needs, DonorPerfect has two ways to send receipts: 1) from the donor record, immediately after entering an individual gift, or 2) from the Receipts module, which allows you to send thousands of receipts at once. You can also quickly and easily set up alerts for pending email receipts and thank you letters.

Generating tax receipts and statements

Types of gifts and receipt options

Donors contribute to nonprofits in various ways (e.g., cash, check, stock, online, in-kind gifts, etc.), and your organization should set up receipt options based on your gift acceptance policies. How donors make their gifts and the frequency of their giving are also factors to consider. For example:

- One-time gifts: Donors should get a receipt immediately upon making a gift.

- Monthly/recurring gifts: Donors should receive a consolidated receipt before the end of February.

Correctly generating and automating tax receipts is essential for maintaining donor trust and organizational efficiency. From donation processing to email integration, leverage your fundraising software’s features to ensure timely, accurate, and compliant tax receipts, while freeing up valuable time and resources to focus on your mission.

On top of great features, the DonorPerfect Canada team has the expertise you need, and you’ll build out receipts when you set up your new DonorPerfect system. Check out our templates and more information in the DonorPerfect Knowledgebase!

Frequently Asked Questions

1. Should my nonprofit organization send a tax receipt and a thank you note separately?

2. Can I increase donor engagement with a receipt form?

3. Do I have to do all of this work manually?