For fundraisers, financial stewardship depends on strong systems, thoughtful oversight, and sound nonprofit accounting practices that support transparency and accountability. From processing donor gifts to managing nonprofit bank accounts and overseeing long-term investments, organizations must balance transparency, accountability, and common sense.

The challenge is that financial risk often hides in everyday processes. Small gaps, an unchecked adjustment, an outdated bank record, or an unclear investment strategy can quietly grow into serious problems.

Finances can feel complex or even intimidating, but financial stewardship does not require nonprofit accounting expertise. It requires curiosity, clear expectations, and an understanding of how daily financial activities connect to long-term organizational health. The lessons below are designed to help boards see where oversight matters most and how thoughtful governance can strengthen financial stability.

Adjusting gifts the right way

Mistakes happen. A donor may request a partial refund because they can’t attend an event, or a gift may be entered incorrectly. Adjusting gifts can involve making changes in multiple places, with little visibility into what was changed and why. This lack of transparency can cause problems for staff efficiency and nonprofit accountability.

A well-designed adjustment process should:

- Allow refunds or voids to be completed within your donor system

- Preserve the original transaction

- Create a clear audit trail showing what changed, when, and why

When gift amounts are adjusted transparently, reconciliation with payment gateways, nonprofit accounting systems, and financial reports becomes far easier. Just as important, audit trails protect both the organization and the staff managing donor data. They reduce confusion, support accurate reporting, and reinforce donor trust by ensuring financial records reflect reality.

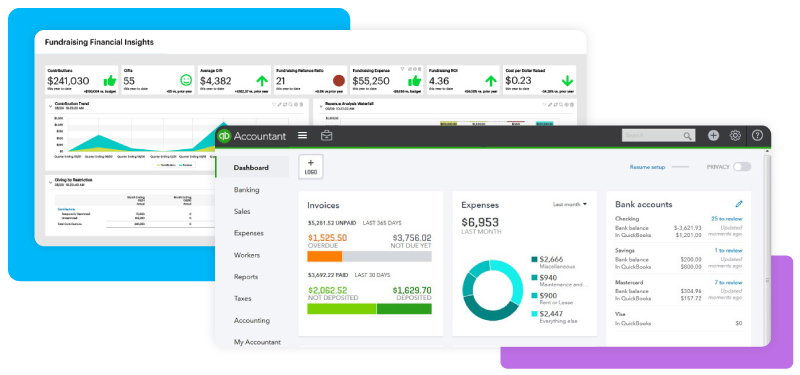

For example: DonorPerfect integrates with nonprofit accounting systems like Intuit Quickbooks Online and Sage Intacct Fundraising.

Plus, its native gift adjustment tools allow organizations to issue refunds or voids without overwriting original transactions. Adjustments are logged with dates, reasons, and user activity, creating a clear audit trail that supports reconciliation and internal review.

Internal controls and separation of duties

Strong internal controls are the foundation of effective nonprofit accounting, helping organizations prevent errors, detect risk, and maintain financial integrity. They’re designed to create systems that work even when people change positions, workloads increase, or mistakes occur.

Good internal controls ensure that:

- The appropriate users authorize, process, and reconcile transactions

- Adjustments, refunds, and voids are reviewed or logged

- Financial activity can be independently verified

These controls are in place to protect your nonprofit and staff. They reduce the risk of error, prevent misunderstandings, and shield staff and volunteers from unnecessary exposure.

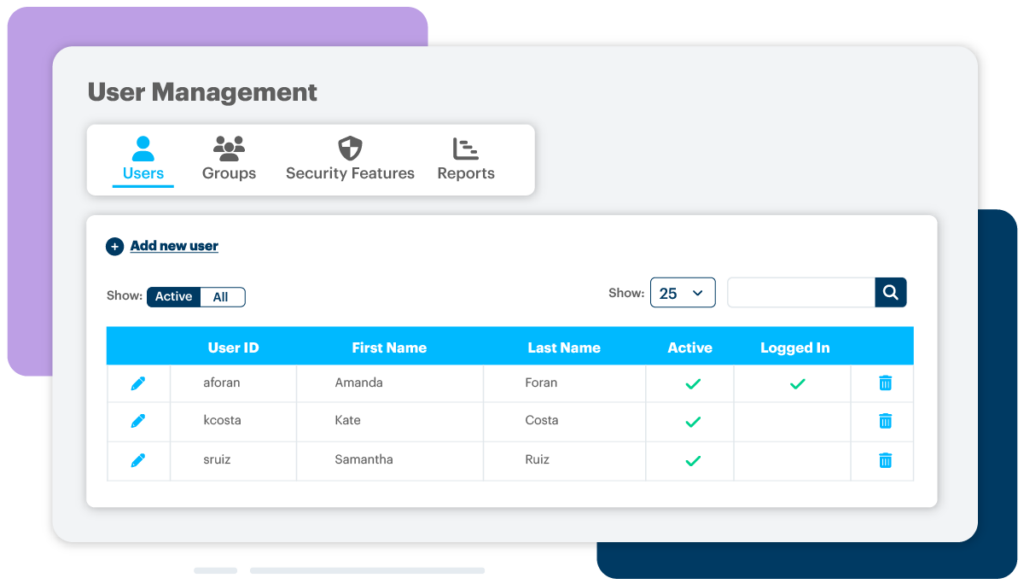

For example: DonorPerfect allows organizations to customize user access in a number of ways to keep data safe, build donor trust, and boost staff confidence.

- Access to specific fields

- Access to records such as donor, contact, or gift records

- Access to tools and functionalities

- Actions a user can perform on records (view, edit, and delete rights)

Managing your nonprofit bank accounts

Nonprofits often assume their banks are enforcing the controls printed on their checks, including dual signatures, authorized signers, and approval limits. In reality, that assumption can be dangerously wrong.

Here are a few examples our fundraising experts have experienced:

- Neither the treasurer nor executive board members were listed as authorized signers

- Former officers from years earlier were still on the account

- An entirely separate bank account existed that no one knew about

How does this happen? Quite simply, banks often do not verify signatures or enforce dual-signature requirements. As long as something resembling a signature is present, checks are frequently processed. Because of this, stewardship must extend beyond the bank’s systems.

Best practices for nonprofits include:

- Regularly confirming authorized signers with the bank

- Work with your bank and staff to uncover forgotten or dormant accounts

- Enforcing internal approval controls even if the bank does not

- Reviewing bank relationships annually, not just during leadership transitions

Organizations can lose track of funds over time due to inactivity, staff transitions, or weak oversight. Strong internal controls are not optional, they are essential

Cash flow and reserves: The risk few boards see coming

A balanced budget does not guarantee financial stability if cash is not available when expenses are due. Grant payments arrive late, fundraising is seasonal, and expenses continue regardless of timing.

Strong financial stewardship includes:

- Monitoring cash flow, not just budget totals

- Understanding timing gaps between revenue and expenses

- Maintaining operating reserves for uncertainty

Without careful attention to cash flow, even financially “healthy” organizations can find themselves unable to meet payroll, pay vendors, or respond to unexpected challenges.

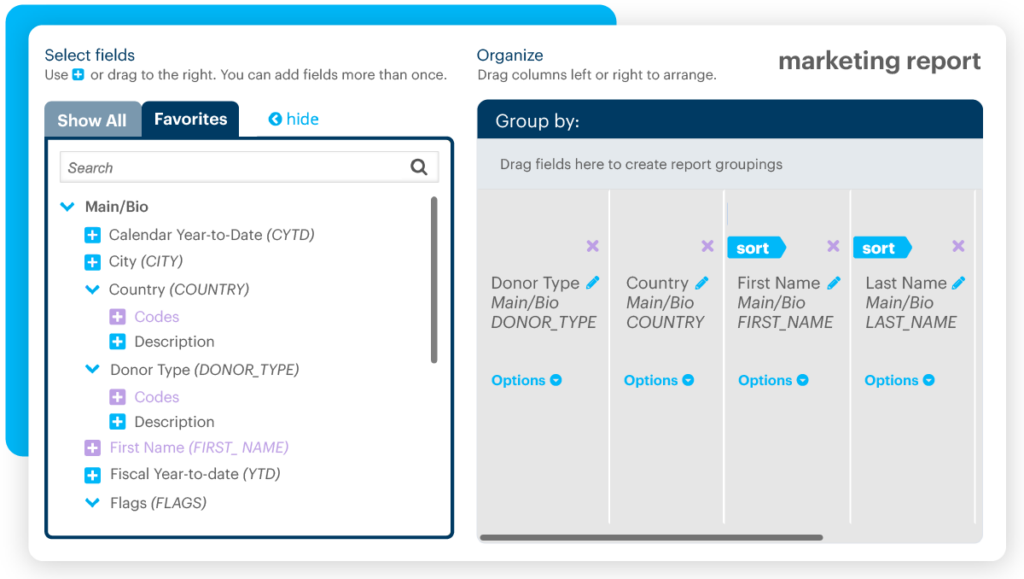

For example: DonorPerfect provides fully-customizable reporting tools to help organizations use giving patterns, timing, and trends to inform cash flow planning.

Restricted funds: Honoring donor intent

Restricted funds are a promise to your donors.

Good stewardship requires:

- Clear tracking of restricted vs. unrestricted funds

- Spending in alignment with donor intent

- Board and staff understanding of restrictions

- Planning to avoid operational dependence on restricted revenue

Using restricted funds improperly, even unintentionally, can damage credibility and donor confidence long after the dollars are spent. Clear policies, education, and tracking systems help ensure that donor trust is preserved.

For example: DonorPerfect allows organizations to track gifts by purpose, restriction, or campaign, making it easier to report accurately and ensure funds are used as intended.

Board and investment committees: Lessons for leaders

At the board level, financial stewardship takes on a different and equally critical form. The Bernie Madoff scandal devastated many nonprofits, not just because of fraud, but because of avoidable governance failures.

The real lessons for nonprofit boards and investment committees are straightforward:

- Do your research – If an investment seems too good to be true, such as consistent positive returns regardless of market conditions, it probably is.

- Don’t invest in what you don’t understand – Complex hedge funds, private equity structures, or opaque strategies demand expertise and oversight most nonprofit boards don’t have time to provide.

- Diversify investments – No nonprofit should have a large percentage of assets tied to a single manager or strategy. Diversification is foundational risk management.

- Understand risk – “Safe” investments that barely keep pace with inflation can quietly erode purchasing power over time, harming the organization just as much as excessive risk.

- Avoid overreaction – After losses or scandals, it’s tempting to retreat entirely into ultra-conservative investments. But long-term nonprofits need growth that modestly exceeds inflation to remain viable.

For many organizations, a simple, low-cost portfolio of diversified index mutual funds is both prudent and effective.

Financial literacy is a shared responsibility

Stewardship cannot be delegated entirely to staff, treasurers, or investment advisors.

Healthy nonprofits:

- Equip board members to read and question financial reports

- Encourage inquiry, not rubber-stamp approvals

- Create a culture where financial clarity is expected

When boards understand the finances, better decisions follow.

Pro tip: Get everyone on the same page with the Clean Data Checklist, a free and customizable resource for fundraising teams of any size—available for download below!

And if you’re a DonorPerfect user, you can improve your clean-up process with a personalized training, system tune-up, or data alignment session—contact your Account Manager for details!)

Financial stewardship not only protects your assets, but also your mission and reputation. When nonprofits treat financial stewardship as an integrated process rather than isolated tasks, they are better positioned to earn trust, navigate uncertainty, and sustain their work.

Follow us on social!